Everybody is talking about SoFi and all its capabilities, but is it really as good as people say? This article will answer this question by evaluating this online banking app’s key features, merits, and limitations.

SoFi Review: My Honest PoV of the Online Banking App

Managing money isn't always easy—between budgeting, saving, and tracking expenses, things can get messy real fast. That's exactly why I started looking for a banking app that could simplify everything in one place, bringing me to SoFi. SoFi promises fee-free banking, high-yield savings, and smart budgeting tools (wrapped up in a mobile app).

I dug deep into SoFi, one of the best fintech apps (allegedly), with my team and I'm pleasantly amazed. For me, SoFi checks a lot of boxes for sure - no maintenance fees, early paycheck deposits, and a user-friendly interface. Sounds good, right?

But let's not go overboard! Like any financial app, it's not perfect. There are some limitations on cash deposits and a few investment features that could be more robust.

So, if you're wondering whether SoFi is the right online banking and budgeting app for you, this SoFi review will break down everything—from its best features to areas where it could improve.

Pros and Cons of Sofi

Pros

- Interest rates on savings accounts are competitive, with up to 3.80% APY for those setting up direct deposit or depositing at least $5,000 monthly

- No monthly maintenance fees and no overdraft charges

- Customers can receive their paychecks up to two days early with qualifying direct deposits

- Integrates various financial services - banking, investments, loans, etc.

- Provides access to financial planning services (career coaching and other perks)

Cons

- Lacks in-person banking services, a drawback for customers preferring face-to-face interactions

- Charges a $4.95 fee for cash deposits and doesn't support them directly

- Some advanced features, like detailed charting tools, may be limited

- Occasional issues with customer service responsiveness

- To earn the maximum interest rate on savings, customers must set up direct deposit or meet specific deposit requirements

Key Features of SoFi Bank

While going through SoFi reviews and my own experience, I got to know some of its mobile banking app features that were especially notable. Here are some of these features:

1. Fee-Free Checking and Savings

Let's be real—bank fees are annoying. With SoFi Checking and Savings, we don’t have to worry about minimum balances, overdraft fees, or monthly maintenance costs. It also comes with access to over 55,000 free ATMs, which has been a lifesaver when traveling.

2. SoFi High-Yield Savings Account

We've all been guilty of keeping money in a basic savings account that earns next to nothing. SoFi's interest rates in savings were a refreshing change. I noticed that my savings were actually growing—way faster than in traditional banks. The APY is competitive, making it a smart choice for hands-off wealth-building.

For instance, if you set up direct deposit or drop $5,000+ every 30 days, you're looking at 3.80% APY on savings and 0.50% on checking.

3. Vaults for Goal-Based Savings

One of my favorite features? SoFi Vaults. Instead of dumping money into a single savings account and mentally keeping track, I could create separate digital "buckets" for different goals—vacations, emergency funds, big purchases—you name it.

No more mental gymnastics or multiple accounts. SoFi Vaults made saving way more organized and stress-free.

4. Commission-Free Investing

Back in the day, I'd get hit with fees left and right, but SoFi Invest? Total game-changer. I can trade stocks and ETFs without paying a dime (in commissions). You can go active and pick your own stocks or let their robo-advisor do the heavy lifting with automated investing. I have been dabbling in fractional shares, too. This means I can own a piece of big-name companies without dropping mad cash. It's perfect for building my portfolio on a budget.

5. Flexible Loan Products

SoFi's loans are available if you need some quick funds. I refinanced my student loans with them a while back because the rates were way better than what I had (saved me a lot of dough).

They've got personal loans up to $100K, home loans, and the works—all with no sneaky fees. The approval process is fast as hell, too; I got cash the same day once. Whether it's consolidating debt or fixing up the crib, they've got options that don't screw you over.

6. Rewards Credit Card

Their credit card—the SoFi Unlimited 2%—is lowkey a flex. You get 2% cash back on everything, and if you book travel through their platform, it bumps to 3%. No annual fee either, which is clutch! Since I've got direct deposit, I get a little extra juice on my rewards, like 2.2% back.

I just toss that cash back into my savings or knock down my loan balance. It's smooth how it all ties together.

7. Automatic Spending Analysis

Ever wondered “where the heck all my money went” every time at the end of the month? SoFi’s Budgeting and Spending feature breaks it down by category—food, travel, shopping, bills—so you can see exactly where your cash is flowing. It was eye-opening for our team when we saw how much we were spending on takeout. No judgment, just better awareness.

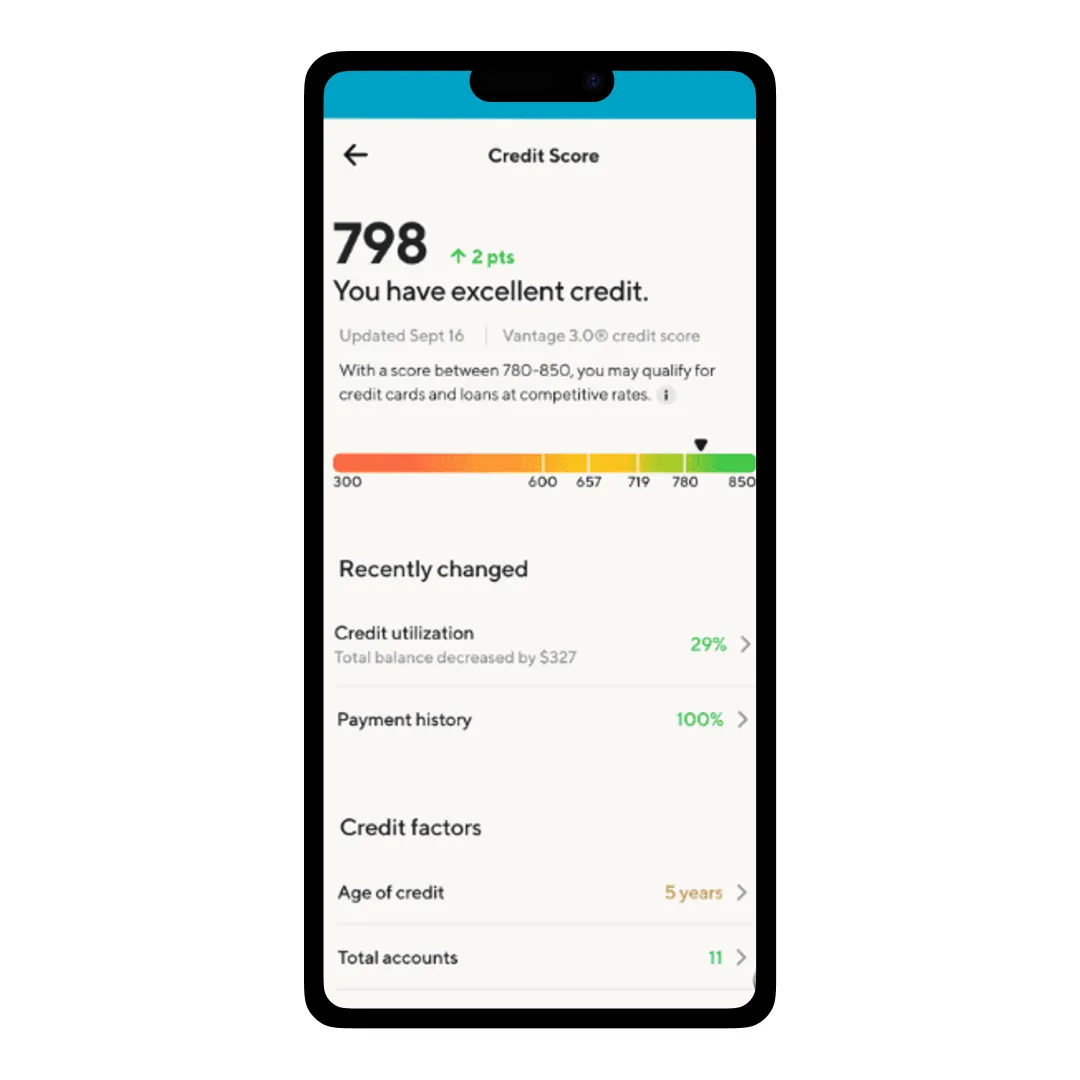

8. Credit Score Monitoring

A lot of financial platforms claim to offer credit score tracking, but some only update monthly, and others hide useful insights behind a paywall. With SoFi, we got free weekly credit score updates based on TransUnion’s VantageScore®. One of our teammates used this feature to track improvements after paying down a credit card balance, and within a week, they saw their score go up!

Moreover, SoFi actually breaks down the five key factors influencing your score (payment history, credit utilization, length of credit history, new credit, and credit mix). I found this useful because, unlike other trackers that just throw numbers at you, SoFi explains why your score changed.

SoFi Bank Account Plans and Pricing

| Feature | Plus Members | Free Members |

|---|---|---|

| SoFi Bank Savings APY | 3.80% APY (9x more than the national average rate) | 1.00% APY |

| Credit Card Cash Back Rewards | Up to 3.3% | Up to 3% |

| Rewards Points (Applicable for Qualifying Account Activity) | 2x | 1x |

| Access to Live Entertainment and Sporting Events | Yes | No |

| One-on-One Financial Planning from SoFi Wealth | Limitless Sessions | 30-min. Introductory Session |

| Unlimited 1% Match on Recurring Deposits to SoFi Invest (Paid in rewards points) | Yes | No |

| Price | $10/per month (free with direct deposit) | Free |

For us, Product Reviews mean diving headfirst into the functionality of each digital product, whether it's an app, software, or website. Our process centers around hands-on testing of each tool we pick. From scrutinizing features to testing vulnerabilities of security standards, the goal remains to help you find products that don't just work but truly elevate your experience. In a nutshell, if we're recommending a product, it's because we believe it'll genuinely make your digital life easier.

- Products Reviewed - 4,000+

- No. Of Experts - 20+

- Categories - 65+

Customer Reviews

How was your experience with the product?

Also Reviewed By Us

What MobileAppDaily Thinks About SoFi Banking & Investing Platform

So, as someone who's been vibing with SoFi for a while now—reviewing it through my MobileAppdaily lens—I've got a lot to say about this online financial company. SoFi is a standout solution in the fintech space, particularly highlighting its well-designed and user-friendly mobile app. The platform has been shaking up the money game since 2011 by delivering exceptional financial services with its own twist.

First off, the app has got it all!

I'm talking about banking, investing, loans, credit cards, you name it! Want more? SoFi's intuitive design makes tasks (like transferring funds, checking balances, and tracking investments) straightforward.

But it's not all good! It's worth noting that some users have pointed out certain drawbacks that are a big "No No." Problems with detailed charting tools were the ones we read about lot. Users have complained that the tool is somewhat limited. This might be a consideration for seasoned investors seeking more in-depth analysis capabilities.

An aspect the team and I appreciated is how much SoFi is committed to a fee-free structure. The absence of account maintenance fees and overdraft charges is a big thing. If I am being real, not having to worry about hidden fees is awesome! I can now trust the platform better and ease myself into the banking experience.

That said, some users have expressed a desire for more traditional banking features. No matter if everything is digital now, some people still long for cash deposit support, which, honestly, SoFi currently lacks. This could be a drawback for individuals who frequently handle cash transactions.

FEATURE

SoFi offers a robust feature set, including high-yield savings, goal-based Vaults, investment options, debt tracking, and credit monitoring.

PRICING

With zero monthly fees, no overdraft charges, and a competitive APY, SoFi stands out as an affordable digital banking option.

PERFORMANCE

The platform runs smoothly with fast transactions and a user-friendly app, though some users report occasional mobile app glitches.

USER FEEDBACK

Most users love the convenience and rewards, but a few have expressed concerns about customer service response times.

Final Thoughts: Should You Switch to SoFi?

After putting SoFi's online banking and budgeting app to the test, it's clear that it has a lot to offer. The benefits it offers are, without a doubt, big wins. The app itself is polished and intuitive and genuinely makes managing money easier.

But no mobile banking app is perfect. If you deal with cash deposits often, SoFi might not be the best fit since options are limited. But be cautious! While their investment tools are decent, they're not as advanced as what you'd get with a dedicated brokerage.

That said, if you're looking for a modern, no-fee banking experience with some 'seriously good' financial perks, go for SoFi. It's a great option for savvy savers and budget-conscious users who want an all-in-one financial platform.

What is Sofi used for?

Our reviewers primarily use Sofi in the following areas:

Sofi

Frequently Asked Questions

What is SoFi?

SoFi (Social Finance, Inc.) is an online financial company that offers a one-stop shop for banking, investing, loans, and credit. Unlike traditional banks, SoFi focuses on fee-free banking, high-yield savings, and smart financial tools. It can be used for everything from high-interest savings to investment tracking - everything in one app, without dealing with annoying branch visits. It’s designed for tech-savvy users who want convenience, strong rewards, and no hidden fees.

Is SoFi a good bank?

If you’re tired of old-school banks charging random fees for no reason, then yes—SoFi is a solid choice. The high 3.80% APY on savings beats most traditional banks, and features like Vaults for goal-based saving, free overdraft coverage, and no minimum balance requirements make it feel customer-first. It is super easy to use for daily banking, investing, and loan tracking, and the cashback rewards on their credit cards don’t hurt either. Just keep in mind—it’s fully digital, so no physical branches.

Is SoFi legit?

Absolutely! SoFi isn’t some sketchy startup—it’s been around since 2011, has millions of users, and is publicly traded on the NASDAQ (ticker: $SOFI). They partner with reputable financial institutions and are regulated just like any traditional bank. SoFi is not a scam, and if you’re looking for a modern banking experience with real perks, it’s worth checking out.

Is SoFi safe?

Security-wise, SoFi is top-notch. They use two-factor authentication, biometric login, and encryption to protect your account. Many users associated with SoFi for a long time say that they never had security issues. According to them, transactions are smooth, and account alerts help you stay on top of everything. The Fraud Protection Guarantee ensures that if unauthorized transactions happen, you won’t be held responsible. Plus, their customer support is actually helpful if you ever run into issues. Bottom line: Your money is in safe hands.

Is SoFi a real bank?

Yes and no. SoFi started as a fintech company, but as of 2022, it officially became a nationally chartered bank under SoFi Bank, N.A. This means it can offer checking and savings accounts, provide loans, and operate like a regular bank. However, it doesn’t have physical branches—everything is done online. But it still functions just like a traditional bank—only way smoother and with better perks.

Is SoFi FDIC insured?

Yes! SoFi is FDIC-insured, which means your deposits are protected up to $2 million through its FDIC Sweep Program. Unlike traditional banks that only cover $250,000, SoFi spreads deposits across multiple banks to increase coverage. It provides extra peace of mind—even if something were to happen, your money is safe and backed by the U.S. government. So, no worries—your funds are secure and insured.

Latest Products

Delve into our comprehensive yet easy-to-consume guides, which provide insights that help scale business faster and prevent unseen pitfalls.

Related Products

Cut through the clutter and explore related digital products that deliver on performance.